Do you want to know a cheeky little secret about how to get cheaper car insurance?

Before I share the secret on how to get cheaper car insurance, let me tell you why I’m a bit car insurance mad at the moment. It’s because Miss Frugal is 17 in a couple of weeks and she is campaigning hard right now for a car.

The car itself isn’t the issue as we have some money set aside for that as it was always our aim to get the kids a car when they passed their test. The issue is the car insurance, which I’ve had some quotes for that would make your eyes water. I knew it was going to be expensive but I wasn’t expecting quotes in the mid thousands for the types of cars that we’re looking at.

How on earth do teenagers afford car insurance?

Anyway, during my insurance costs traumas, I got an email from By Miles telling me all about a fantastic new idea to help people save money on car insurance. Basically, they base the cost of their insurance on the distances you drive which could mean big savings for those of you who drive lower mileage. They say that their aim is to offer competitive car insurance prices to people who drive less than 7,000 miles a year which would rule me out with my big commute but I thought lots of you might be interested.

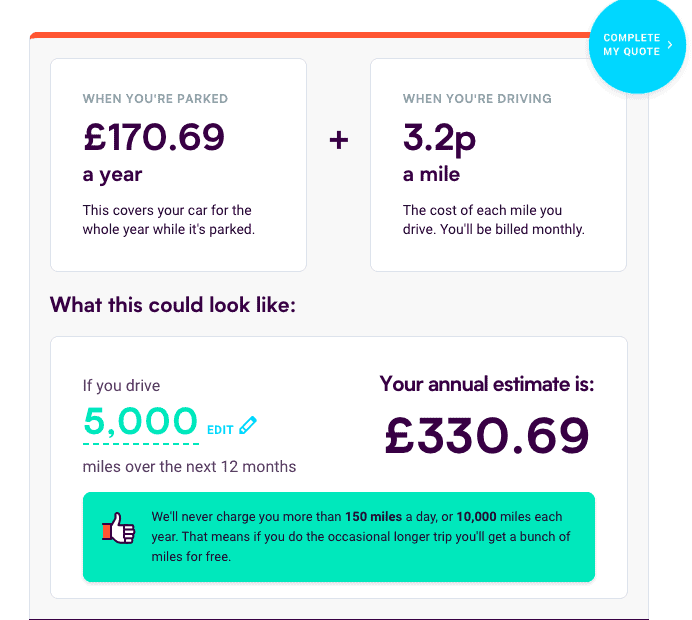

It won’t help me with Miss Frugal’s insurance costs as they can’t insure drivers under 25 at the moment but to give you an idea, I thought I’d try it based on my current policy but based on a much lower mileage – the kind of mileage I’d be using if I had just a short commute to work or if I didn’t use my car daily. I based in on 5000 miles a year which is 416 miles a month and to put some perspective on that, a round trip to where Mr Frugal works out at 3 miles, 5 days a week. A trip to our local town is the same 3 miles round trip whereas a round trip to our nearest ‘big’ town is 12 miles. So if I didn’t have my 80-mile round trip commute and just used my car to pootle around in then I would be saving a fair amount…

So, if I did 5000 miles a year then it would work out to under £28 a month for a fully comprehensive policy.

A lower mileage of around 3000 miles a year would work out annually at around £266 which could represent a pretty big saving if you don’t rack up the miles as I do.

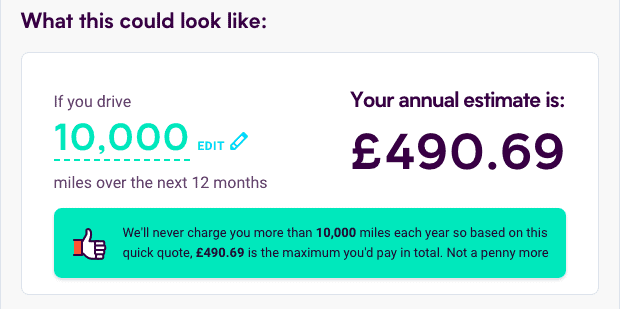

And you don’t even have to worry too much about it if you had to change your driving habits for some reason and suddenly start driving more miles (look at me with my recent work relocation) because if that was to happen, you’d never be charged for more than 10,000 miles which in my case would work out to £490 a year (£41 a month).

Obviously, the savings here are for people who drive fewer miles but I wanted to make sure that it wouldn’t cost you a small fortune if you drove more than expected for some reason. There’s no point being scared to drive your car in case you rack up a huge bill so I wanted to be able to reassure you that you’d not end up paying a ridiculous amount if you go over your estimate.

So, if you want to see if you can get cheaper car insurance, why not go see what your quote would be with By Miles. It took me about two minutes to get mine and I know how much I’d save if only I drove fewer miles.

This is my affiliate link which means you get the same quote but I’ll get a payment too if you do end up taking out a policy:

Get a Quote to see if you can get cheaper car insurance

I’d love to hear if you make a saving so please do let me know.

And now I’ve solved your car insurance problem, I need to get back to working on a way to get cheaper car insurance for a teenager which I suspect isn’t going to be as easy!

Don’t miss out on future posts like this – receive updates directly to your inbox by email by adding your email address here and hitting subscribe. You can also follow me on Twitter or BlogLovin and I’d love to see you over on my Facebook page and on Instagram. If you’re interested, you can find out more about me here. 😉

Why not pin ‘How to get cheaper car insurance if your mileage is low’ for later: